Behind the Click: The Real Story of a Crypto Trade

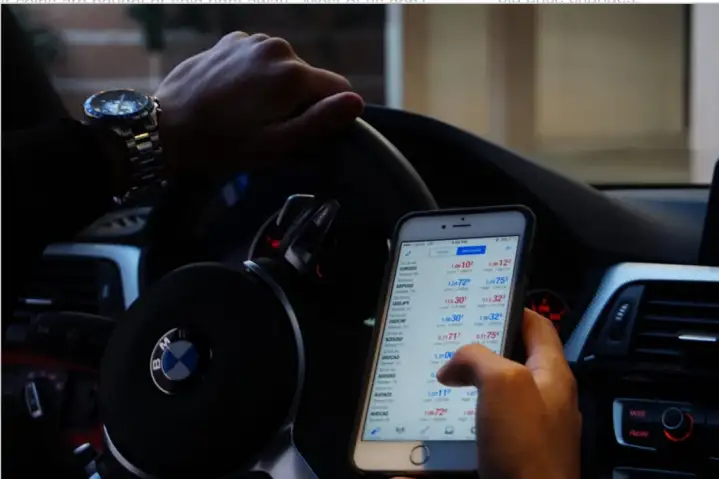

Trading crypto can feel like magic. When you open the app and tap a button, your coins are bought or sold right away. Most of us don’t give it much thought because it works so quickly and smoothly. But behind the scenes, a quiet system works all the time to make sure your trades go through. Without it, many coins would just sit there, frozen — no buyers, no sellers, no action.

This is where market makers step in. These are the unsung heroes of crypto. Platforms like crypto market making from CLS Global help keep markets alive and active. They’re the reason you can sell a niche token at 2 AM or buy a low-volume coin without breaking the price. Their job? Make sure there’s always someone on the other side of your trade — no matter what.

Market Makers: The Quiet MVPs of Crypto

What do market makers really do? Think of them as sellers who are ready to buy or sell at any time, even when no one else is around. The market stays “liquid” because of this steady presence. This means that it’s easy to trade without having to wait or deal with big price changes.

This is why they’re important:

- Without them, costs could go up or down with every small trade, which would be awful. Market makers help smooth things out.

- They keep spreads tight: That’s the difference between buying and selling prices. Narrower spreads mean you get better deals.

- They give confidence: If a coin looks active and tradable, more people are likely to trust it. Market makers help create that activity.

It’s not just bots, either. Automation is important, but the best market makers also use strategy, human reasoning, and the ability to make decisions in real time.

Not Every Coin Is Born Ready

Imagine you launch a new token. It’s got a cool name, a decent whitepaper, and some early hype. But when people check the exchange, there’s no volume. Nobody’s trading. The chart is flat. That kills trust fast.

Market makers fix this. They create an environment where your coin feels alive from day one. By constantly placing buy and sell orders, they make the token look healthy, even before real users arrive. This is why many serious crypto projects partner with companies like CLS Global — because good market making can make or break a token’s reputation.

Real Traders Feel the Difference

If you’ve ever tried to sell a small-cap coin and seen the price drop 10% from your trade — congratulations, you’ve met a market without market making. These thin, unstable markets are frustrating and risky. You lose money just by trying to exit.

In contrast, a well-managed token feels different. You can move in and out without stress. Your trades don’t break the chart. That’s what strong market making looks like. It’s invisible when it’s working — and painfully obvious when it’s not.

A List of What Market Makers Actually Do

Let’s make it extra clear. Market makers:

- Place constant buy/sell orders

- Make trading faster and smoother

- Reduce price volatility

- Help new tokens build credibility

- Support exchange listings with liquidity

- Improve the overall trading experience

They don’t hype. They don’t shill. They don’t moon. They just make the market — literally.

Wrapping It Up: Why You Should Care

You don’t need to be a crypto expert to appreciate what market makers do. If you’ve ever placed a trade and it went through quickly, thank them. If your coin didn’t crash when someone sold $500 worth, thank them. If you’re building a project and want real users to take you seriously — hire them.

Crypto is still growing up. And while the headlines talk about price pumps and scandals, the infrastructure — the people keeping everything working — are the ones who actually deserve your attention.

Market makers are part of that foundation. Quiet, reliable, and absolutely essential.